Manmohan Singh gave three suggestions to the Modi government to get out of the crisis

According to former Prime Minister Dr. Manmohan Singh, India should take three steps immediately to deal with the damage caused by the corona virus epidemic.

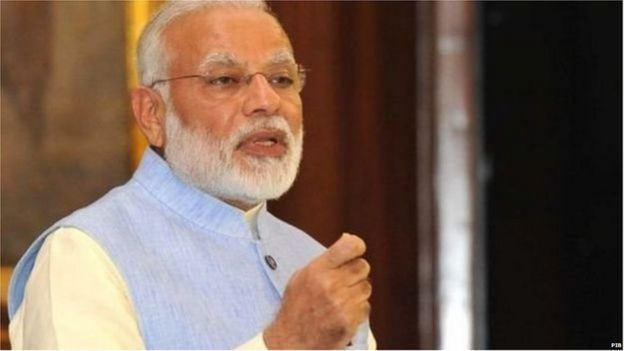

Dr. Singh is largely credited for the economic reform program in India. Manmohan Singh has talked to the BBC this week via email. Due to Corona virus, there was no scope of discussion sitting face to face. However, Dr. Singh refused the interview through a video call.

In an email conversation, Manmohan Singh mentioned three steps needed to prevent the corona virus crisis and normalize the economic conditions in the coming years.

What are the three steps suggested by Dr. Singh ?

The first step, he says, is that the government should “ensure that people’s livelihoods are protected and that they have enough money to spend on their hands directly through cash assistance.”

Second, the government should provide sufficient capital for businesses. For this, a “government-backed credit guarantee program should be run.”

Third, the government should solve the problems of the financial sector through “institutional autonomy and procedures”.

Before the epidemic started, India’s economy was in the grip of lethargy. In 2019-20, the country’s GDP (gross domestic product i.e. gross domestic product) has increased at a rate of just 4.2%. This is its lowest growth rate in nearly a decade.

After a long and difficult lockdown, India has now started opening up its economy slowly. But, the number of infected is continuously increasing and in such a situation the future seems uncertain.

On Thursday, India became the third country to cross the 20 lakh mark in terms of Covid-19 cases.

Economic slowdown

Economists have been warning ever since that India’s GDP growth could decline for the financial year 2020-21 and this could lead to the worst recession since the 1970s.

Dr. Singh says, “I don’t want to use a word like ‘depression’, but a deep and long-lasting economic slowdown is certain.”

He says, “This economic slowdown has come due to humanitarian crisis. It needs to be seen from the perspective of the spirit of our society rather than merely economic data and methods.”

Dr. Singh says that there is a consensus among economists about the economic contraction (economic contraction) in India. He says, “If this happens then it will be the first time in India after independence”.

He says, “I hope that this agreement is proved wrong”.

Enforced lockdown without consideration

India implemented a lockdown in late March to prevent the spread of corona virus. Many believe that the lockdown was implemented in haste and it was not anticipated that lakhs of migrant laborers would leave big cities and move to their villages and towns.

Dr. Singh believes that India did what other countries were doing and “there was no other option but lockdown at that time”.

He says, “But, the government’s sudden implementation of this major lockdown has caused unbearable pain to the people. There was no thought behind the lockdown’s sudden announcement and its strictness and it was insensitive.”

According to Dr. Singh, “Public health emergencies such as the corona virus can best be dealt with through local administration and health officers. Extensive guidelines were issued by the Center for this. Perhaps we need to fight the Covid-19 State and local administration should have been handed over somewhere before. “

Dr. Singh, the leader of the economic reforms of the 90s

A Balance of Payments (BOP means the difference between the total capital coming out of the country and the capital going out of the country at a given point of time) After the crisis almost reached the verge of bankruptcy in India, as Finance Minister Dr. Singh led an ambitious economic reform program in 1991.

He says that the 1991 crisis was a domestic crisis caused by global factories. According to Dr. Singh, “But the current economic situation is extraordinary because of its prevalence, scale and depth.”

He says that even in the second world war “the whole world was not closed together like it is today.”

How will the government meet the shortage of money?

In April, Narendra Modi’s BJP-led government announced a relief package of $ 266 billion. In this, measures were taken to increase the cash and announced steps to improve the economy.

The Central Bank of India, Reserve Bank of India, ie RBI has also taken steps like cutting interest rates and giving relaxation in repayment of loan installments.

With the fall in tax paid to the government, economists are debating how the government, which is suffering from cash shortage, will raise money for direct transfer, provide capital to sick banks and provide loans to businessmen.

Debt to wrong not

Dr. Singh tells the answer to the borrowers. He says, “More borrowing is certain. Even if we have to spend an additional 10% of GDP to meet military, health and economic challenges, we should not back down.”

They believe that this will increase India’s debt to GDP ratio (ie GDP to debt ratio), but if borrowing can “save lives, the country’s borders, restore people’s livelihoods and increase economic growth.” So there should be no risk in doing so. “

He says, “We should not be ashamed to borrow, but we should be sensible about how we are going to spend this borrowing.”

Dr. Singh says, “In the past, taking loans from multinational institutions like IMF and World Bank was considered as a weakness of the Indian economy, but now India can take loans with stronger status than other developing countries.”

He says, “India has a great track record as a borrowing country. Taking loans from these multinational institutions is not a sign of weakness.”

Will avoid printing money

Many countries have decided to print money to overcome the current economic crisis so that money can be raised for government expenditure. Some important countries have suggested the same thing to India. Some other countries have expressed concern that this will pose a risk of rising inflation.

Until the mid-1990s, the fiscal deficit (financial deficit) was directly compensated by the RBI and was a common practice.

Dr. Singh says that India has now moved forward with “financial discipline, bringing institutional freedom between the government and the Reserve Bank and curbing free capital”.

He says, “I know that the traditional fear of high inflation due to more money coming into the system is probably no longer in the developed countries. But, with the RBI’s autonomy being hurt for countries like India, unbridled way of printing money The effect can also be seen in the form of currency, trade and inflation. “

Dr. Singh says that he is not rejecting printing money to make up for the deficit, but rather “merely suggesting that the level of resistance should be very high for this and only using it as the last fodder.” When all the other options have been used. “

India left from protectionism

They warn India to become more protectionist (imposing trade barriers like imposing a higher tax on imports) on the lines of other countries.

He says, “In the last three decades, India’s trade policy has benefited every section of the country.”

As Asia’s third largest economy, today India is in a far better position than it was in the early 1990s.

Dr. Singh says, “India’s real GDP is 10 times stronger today than it was in 1990. Since then India has pulled out more than 30 crore people from poverty.”

But, an important part of this growth has been India’s trade with other countries. The share of global trade in India’s GDP has increased almost five times during this period.

This crisis forced everyone

Dr. Singh says, “India has got more mixed with the world today. In such a situation, anything that happens in the world economy also affects India. In this epidemic the global economy is badly hurt and it Is also a matter of concern. “

At the moment, no one knows the full economic impact of the corona virus epidemic. Nor does anyone know how long it will take for the countries to overcome this. But, one thing is clear that it has also defeated the experience of old economists like Dr. Singh.

He says, “The previous crises were macroeconomic crises for which tried-and-tested economic tools are in place. Now the key is facing an economic crisis arising out of an epidemic that has filled uncertainty and fear in society. To deal with this crisis, monetary Using the policy as a weapon is not proving effective. “

Average Rating